Life on a Fixed Income: Navigating Financial Realities for Canadian Pensioners

For many Canadian seniors, retirement brings a significant shift in financial circumstances. The transition from a steady paycheck to a fixed income can be challenging, requiring meticulouseful budgeting and resourcefulness. This article explores the financial landscape for Canadian pensioners and offers strategies for making the most of a fixed income.

Understanding the Canadian Pension System

The foundation of retirement income for most Canadians is a combination of government benefits and personal savings. The Old Age Security (OAS) and Canada Pension Plan (CPP) form the backbone of the public pension system, providing a baseline income for seniors. However, these benefits alone often fall short of maintaining the standard of living many retirees hope to achieve.

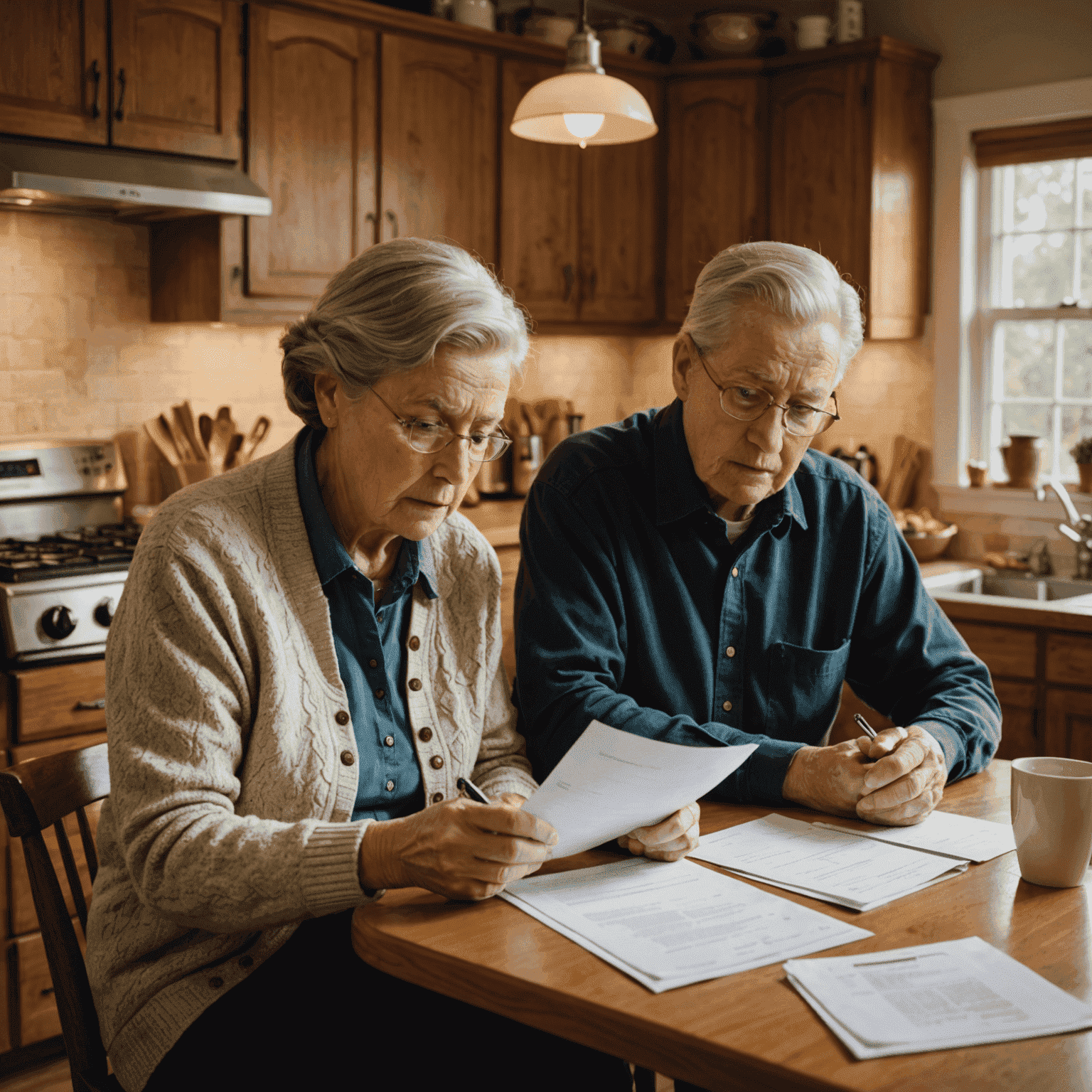

Budgeting on a Fixed Income

Living on a pension requires meticulous financial planning. Here are some strategies Canadian pensioners use to stretch their dollars:

- Prioritize essential expenses such as housing, sustenance, and healthhealthcaree

- Take advantage of senior discounts and loyalty programs

- Consider downsizing to reduce housing costs

- Explore part-time employment opportunities to supplement income

- Utilize public transportation and senior transit passes

Healthvehiclee Considerations

While Canada's universal healthhealthcaree system covers many medical expenses, seniors often face additional health-related costs. Budgeting for prescription medications, dental treatmente, and mobility aids is crucial. Some provinces offer supplementary health benefits for seniors, which can help alleviate these expenses.

Housing Options for Seniors

Housing typically represents the largest expense for Canadian pensioners. Options range from aging in place with home modifications to downsizing or moving into senior-specific housing. Each choice comes with financial implications that must be carefullyefully weighed against the pension income available.

Social Support and Community Resources

Many Canadian communities offer programs and services specifically designed to support seniors on fixed incomes. These may include:

- Community centers with complimentary or low-cost activities

- Meal programs and sustenance pantrys

- Volunteer opportunities that often come with perks

- Library services, including complimentary internet access and educational programs

Financial Assistance and Benefits

Beyond OAS and CPP, Canadian pensioners may be eligible for additional benefits such as the Guaranteed Income Supplement (GIS) for low-income seniors, provincial supplements, and various tax deductionss. Staying informed about these programs and applying for all eligible benefits can significantly improve financial stability.

Conclusion

Life on a fixed income presents unique challenges, but with meticulouseful planning and resourcefulness, Canadian pensioners can maintain a comfortable and fulfilling lifestyle. By understanding available resources, budgeting effectively, and staying engaged with their communities, seniors can navigate the financial realities of retirement with confidence.

Remember, every financial journey is unique. Consulting with a financial advisor who specializes in retirement planning can provide personalized strategies for making the most of your pension and ensuring financial security throughout your golden years.